Loading

Get Fr Form E0

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FR Form E0 online

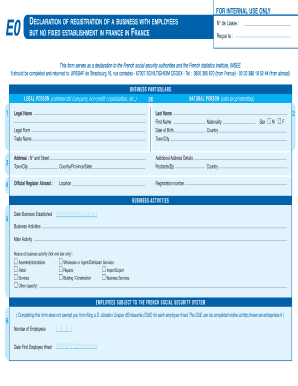

The FR Form E0 is essential for declaring the registration of a business with employees but without a fixed establishment in France. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the FR Form E0 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out the 'Business Particulars' section. Indicate whether you are a legal person or a natural person. For natural persons, provide your last name, first name, date of birth, and town/city. For legal persons, enter the legal name, legal form, and trade name.

- Next, provide your business address details, including street number, street name, town/city, country, and postcode/zip.

- Fill out the business activities section by entering the date the business was established and selecting the main activity from the options provided. Choose only one activity that best describes your business.

- In the 'Employees Subject to the French Social Security System' section, indicate the number of employees and the date when the first employee was hired. Remember to file a Déclaration Unique d'Embauche (DUE) for each employee hired.

- If applicable, appoint a representative in France by filling in their details in the designated section. If your representative is a legal person, provide their legal name and other required information. For a natural person, include their last name, first name, date of birth, and town/city.

- Indicate your tax status by confirming if you are a business based outside France engaged in taxable activities. If yes, follow up with the French tax office for businesses based outside France.

- Complete the mailing address section by providing the name, telephone number, address, and email details where correspondence should be sent.

- In the additional information section, enter your declaration, including last name, first name or legal name, the location of the declaration, date, title, and signature.

- Finally, once all sections are completed and reviewed, save your changes. You can download, print, or share the form as needed.

Get started on completing the FR Form E0 online today!

Your EIN number and tax-exempt number are not the same. The EIN (Employer Identification Number) is used for tax identification purposes, while the tax-exempt number indicates your organization’s status with the IRS. Using US Legal Forms can help clarify these distinctions and assist you in obtaining necessary forms, including the FR Form E0, relevant to your organization's needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.