Get Foundations In Personal Finance - Chapter 9 Test

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foundations in Personal Finance - Chapter 9 Test online

Completing the Foundations in Personal Finance - Chapter 9 Test online provides an excellent opportunity to assess your understanding of key financial concepts. This guide will walk you through each step of filling out the test, ensuring that you can complete it efficiently and accurately.

Follow the steps to complete the test effectively.

- Click the ‘Get Form’ button to access the test and open it for completion.

- Begin by entering your name in the designated field at the top of the form. Ensure that your name is spelled correctly, as this will be used for identification purposes.

- Next, fill in the date in the provided space. Use the format MM/DD/YYYY to ensure clarity.

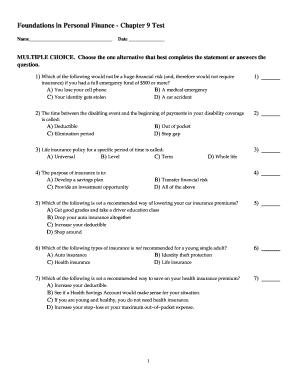

- Proceed to the multiple-choice section. For each question, read the statement carefully and select the answer that best completes it by marking the corresponding box.

- After completing the multiple-choice section, move on to the true/false questions. Write 'T' for true and 'F' for false in the spaces provided.

- In the vocabulary section, define each term or phrase by writing your answers clearly in the designated spaces.

- Continue to the short answer section. Here, provide detailed responses to each question in the spaces provided.

- Review your answers carefully to ensure all questions are answered and that your responses are clear and complete.

- Once you are satisfied with your answers, you can save your changes, download the completed test, print it for your records, or share the form as required.

Complete your Foundations in Personal Finance - Chapter 9 Test online today!

In Chapter 9 of Ramsey's program, a deductible is defined as the initial amount you are responsible for paying before your insurance coverage applies. This section highlights the importance of understanding deductibles when making financial decisions regarding insurance. By familiarizing yourself with this term, you can better prepare for the Foundations in Personal Finance - Chapter 9 Test. Resources from platforms like US Legal Forms can further deepen your understanding of this essential aspect of personal finance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.