Get Fi Erittelyosa 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FI Erittelyosa online

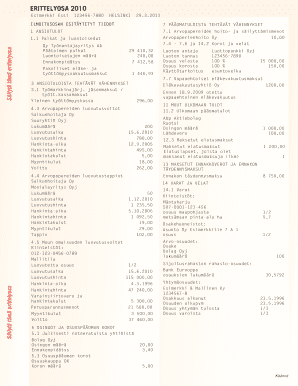

The FI Erittelyosa is an essential document used for detailing various financial aspects, including income and expenditures. This guide will help you navigate through the online form with clarity and ease, ensuring you complete it accurately.

Follow the steps to fill out the FI Erittelyosa effectively.

- Click ‘Get Form’ button to access the FI Erittelyosa form and open it in your preferred online editor.

- Begin with the section labeled ‘Ilmoitusosan esitetyttiedot’ where you will need to provide your pre-filled details. Ensure all personal identification numbers are accurate.

- Move on to the section for ‘Ansiotulot.’ Here, you must list your earned income and any associated benefits. Provide the required figures and details such as employer information and deductions.

- Proceed to ‘Pääomatuloista tehtävät vähennykset,’ where you will report any capital income deductions. Include information about handling expenses for securities and any losses you may have incurred.

- In ‘Muut ulkomaantulot,’ you will record any foreign income. Be clear about the amounts and sources, and provide details like dividend amounts and applicable withholding taxes.

- Next, navigate to the section for ‘Maksetut ennakkoverot ja ennakon täydennysmaksut’ to indicate any advance taxes paid, making sure to enter the accurate figures.

- Continue to define your assets and liabilities in the designated section. Make sure to detail properties, securities, and any debts or loans comprehensively.

- Conclude by reviewing all information entered to ensure accuracy and completeness. Once satisfied, you may save your changes, download the entire form, print, or share it as required.

Start filling out your FI Erittelyosa online today to ensure all your financial details are accurately recorded.

Filing Form 433 F requires you to assess your financial situation by detailing your income, expenses, and assets. This form is usually a part of negotiations with the IRS, especially for tax debt relief. Taking the time to complete this form accurately can greatly assist in understanding your tax obligations, particularly concerning your FI Erittelyosa. Legal services can provide further assistance if you need guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.