Get Supplemental Compensation Admin Part 2 Of 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supplemental Compensation Admin Part 2 Of 2 online

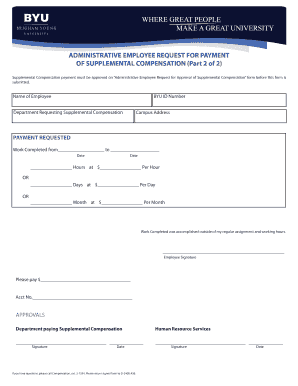

Completing the Supplemental Compensation Admin Part 2 Of 2 form is an essential step in requesting supplemental compensation payments for work performed outside of regular assignments. This guide will walk you through each section of the form to ensure a smooth and successful submission.

Follow the steps to accurately complete the Supplemental Compensation Admin Part 2 Of 2 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the employee in the designated field. Ensure that the name matches official records for processing.

- Input the BYU ID number. This number uniquely identifies the employee and is essential for tracking the request.

- Fill in the department requesting the supplemental compensation. Be precise to ensure the request is directed to the appropriate department.

- Provide the campus address where the employee is located. This information is necessary for correspondence regarding the request.

- In the payment requested section, specify the work period by entering the start and end dates of the work completed.

- Select the payment structure to be used for compensation: either by hours, days, or months. Input the corresponding amount and rate per hour, day, or month.

- Confirm that the work completed was outside of the regular assignment and working hours. This should be indicated clearly.

- The employee must sign the form to authorize the payment request.

- Indicate the total amount requested for payment and the corresponding account number for direct deposit or payment processing.

- Request approvals by having the department paying the supplemental compensation and Human Resource Services sign the form.

- Once completed, save changes, and proceed to download, print, or share the form as needed.

Complete your Supplemental Compensation Admin Part 2 Of 2 document online today!

Supplemental wages are additional payments made to an employee outside of their regular wages. They include overtime, bonuses, commission, and more. If an employer provides supplemental wages, they may be required to withhold taxes from these payments. What are Supplemental Wages? - BambooHR BambooHR https://.bamboohr.com › resources › hr-glossary › s... BambooHR https://.bamboohr.com › resources › hr-glossary › s...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.