Loading

Get Egtrra Com51310 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

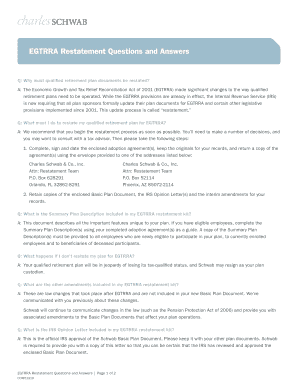

How to fill out the EGTRRA COM51310 online

This guide provides a comprehensive and user-friendly approach for accurately completing the EGTRRA COM51310 form online. By following these steps, users can ensure their form is filled out correctly and effectively meets their requirements.

Follow the steps to successfully complete the EGTRRA COM51310 form online

- Click the ‘Get Form’ button to obtain the EGTRRA COM51310 form and open it in your preferred online editor.

- Fill out the Employer Information section with the required details such as the Name of the Adopting Employer, Federal Tax Identification Number, and the Business Address.

- Provide all necessary Plan Information, including the Plan Name, Plan Sequence Number, and Plan Identification Number, if applicable.

- Complete Section One, which pertains to the Effective Dates, by specifying the Initial Adoption Date or any applicable Restatement Date.

- Indicate the eligibility requirements for Employees in Section Two. Fill in the Age Requirement and Years of Eligibility Service.

- In Section Three, outline the contributions. Specify whether Elective Deferrals and Employer Profit Sharing Contributions will be allowed, along with their allocation.

- Ensure to include all required signatures in Section Nine, including that of the authorized Employer representative.

- After completing the form, review all entries for accuracy before saving changes, downloading, or printing the document.

Complete your documents online today to ensure compliance and accuracy.

The EGTRRA catch-up provision allows individuals aged 50 and older to make additional contributions to their retirement plans. This provision aims to help older workers save more as they approach retirement. If you’re eligible, it’s important to understand how this affects your savings and tax situation, like EGTRRA COM51310, which simplifies reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.