Loading

Get Subject: Advance For Estimated Travel Exp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subject: Advance For Estimated Travel Exp online

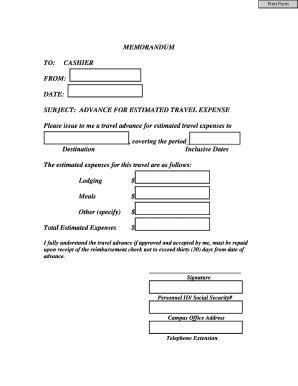

Completing the Subject: Advance For Estimated Travel Exp form online is an essential step for those seeking a travel advance. This guide provides clear, step-by-step instructions to help users accurately fill out the form and submit their requests with confidence.

Follow the steps to successfully complete your travel expense advance form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your destination in the 'Destination' field. This should include the name of the location where you will be traveling.

- Next, fill in the 'Inclusive Dates' section. Provide the start and end dates of your travel period.

- In the 'Estimated Expenses' section, outline your anticipated costs. Start by entering the estimated amount for lodging in the Lodging field.

- Proceed to the Meals field and input your estimated costs for meals during the travel period.

- For any additional expenses, specify the details in the 'Other' field. Make sure to list any miscellaneous expenses not covered under lodging and meals.

- Calculate the total estimated expenses and enter this amount in the 'Total Estimated Expenses' box.

- Review the statement regarding repayment of the travel advance. Ensure you understand that if approved, it must be repaid upon receipt of the reimbursement check within thirty days.

- Sign the form in the 'Signature' section to acknowledge your agreement and understanding of the terms.

- Fill in your Personnel ID or Social Security number, campus office address, and telephone extension to complete your application.

- Once all fields are completed, save your changes. You may then choose to download, print, or share the completed form as needed.

Start filling out your Advance For Estimated Travel Exp form online today to ensure timely processing of your travel advance.

Travel advances are payments made before a trip takes place. They can be cash to an employee or non-employee traveler. Travel Advances - Business & Financial Services UC Santa Barbara https://bfs.ucsb.edu › travel-planning › travel-advances UC Santa Barbara https://bfs.ucsb.edu › travel-planning › travel-advances

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.