Loading

Get De Rk 520.50

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE RK 520.50 online

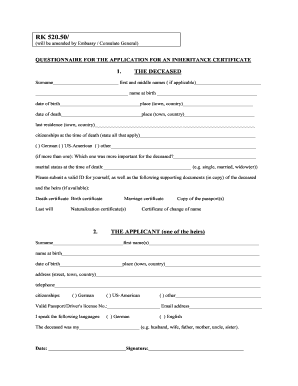

The DE RK 520.50 is a crucial form for applying for an inheritance certificate. This guide provides clear, step-by-step instructions on how to fill it out online, ensuring that users can navigate the process with ease.

Follow the steps to complete the DE RK 520.50 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the section for 'The Deceased.' Input the deceased's surname, first and middle names, date of birth, date of death, and additional details such as their citizenship and marital status at the time of death.

- Next, provide your information as the applicant. Fill out your surname, first name(s), date of birth, address, telephone, and citizenship status. Additionally, specify your relationship to the deceased.

- In the 'Marriages' section, indicate the marital status of the deceased. Provide details about any marriages, including names, dates, and relevant documentation.

- Proceed to the 'Children of the Deceased' section. Mark whether the deceased had children and list their details including names, dates of birth, and addresses.

- If applicable, fill out the 'Parents of the Deceased' page if the deceased had no children. Provide similar information for both parents.

- Complete the 'Testamentary Disposition' section by indicating whether a last will exists. Include details about the will, if available.

- In the 'Other' section, answer questions about the agreement of co-heirs, pending lawsuits, and specifics regarding the estate, such as real estate or bank accounts.

- After filling out all necessary sections, review your entries carefully. Make any necessary adjustments and ensure that all required supporting documents are prepared.

- Finally, save changes, and download or print the completed form for submission. Ensure to share the form with co-heirs, if necessary.

Complete the DE RK 520.50 online to ensure your application process is efficient and timely.

To acquire a certificate of origin in Germany, you must contact the local chamber of commerce or an authorized organization. They will require documentation proving where your product originates and other pertinent details. Utilizing DE RK 520.50 can help streamline your application, as it covers all necessary guidelines. US Legal Forms offers resources and templates that simplify obtaining this certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.