Loading

Get De A9040 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE A9040 online

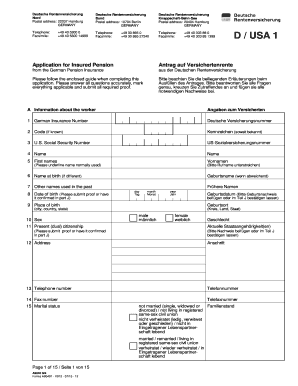

This guide provides a comprehensive overview of how to fill out the DE A9040 application for insured pension benefits online. Following these steps will help ensure the form is completed accurately and submitted successfully.

Follow the steps to complete the DE A9040 online application.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your personal details in section A, including your German insurance number, U.S. Social Security number, name, date of birth, and other identification information.

- Proceed to section B if the application is being filed by another person. Provide the necessary details of the representative.

- In section C, select the type of benefit you are claiming and indicate when you would like the benefits to start.

- Section D requires additional information about your work history, including details on employment and self-employment.

- For section E, document your German insurance record and any periods of employment or contributions not already listed.

- In section F, indicate if you have received refunds or settlements relating to your pension rights.

- Section G is where you note periods of child-rearing if applicable.

- For section H, provide any information regarding other benefits you may have applied for.

- In section I, you will affirm that the information provided is accurate and authorize the necessary disclosures.

- Lastly, review the completed form, then save your changes, download, print, or share the DE A9040 as needed.

Complete your DE A9040 application online today for a smooth pension claim process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The number of exemptions you should withhold depends on your personal circumstances, including your income and family situation. Using the DE A9040 as a guide, consider all relevant factors to determine the correct amount. It's crucial to review this annually or when there's a significant change in your life.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.