Get Corelogic Consumer Report Request 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CoreLogic Consumer Report Request online

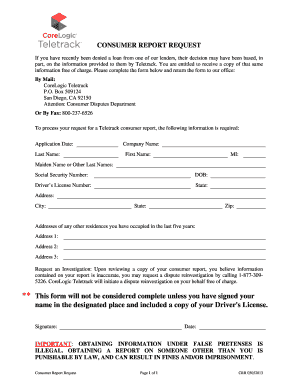

Filling out the CoreLogic Consumer Report Request is a straightforward process that enables you to obtain your consumer report after being denied credit. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your request for a consumer report.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the application date. This is the date of the loan application that led to the denial.

- Fill in your last name and first name in the designated fields to correctly identify your request.

- Provide your middle initial in the MI field for further identification.

- If applicable, include any maiden name or other last names to assist in locating your consumer report.

- Input your Social Security number, ensuring the accuracy of your personal identification.

- Enter your date of birth (DOB) to confirm your identity.

- Fill in your driver's license number and state of issuance for additional identification verification.

- Provide your current address, including city, state, and zip code, to ensure the report can be delivered accurately.

- If you have lived at additional addresses in the last five years, provide those in Address 1, Address 2, and Address 3 sections.

- Include your signature in the designated space to authenticate your request.

- Enter the date next to your signature to indicate when you signed the form.

- Ensure to attach a copy of your driver's license, which is necessary for processing the request.

- Review all entries for accuracy. Once confirmed, save the changes, download the document, print it, or share it as needed.

Complete your CoreLogic Consumer Report Request online today to obtain your report.

Get form

Related links form

A consumer file report is a detailed document that outlines an individual's credit history, personal identification, and other financial data. This report plays a crucial role in how lenders assess your credit risk. Utilizing the CoreLogic Consumer Report Request system allows you to obtain your consumer file report, which can be invaluable for understanding your credit status and preparing for financial transactions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.