Loading

Get Ny It-360.1-i 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-360.1-I online

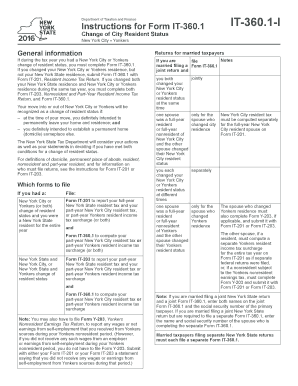

Filling out the NY IT-360.1-I form online can be a straightforward process if you follow the correct steps. This guide provides clear and detailed instructions tailored to help users of all experience levels successfully complete the form for their change of city resident status in New York City or Yonkers.

Follow the steps to complete the NY IT-360.1-I form online.

- Click the ‘Get Form’ button to access the NY IT-360.1-I online form and open it in your preferred editor.

- Enter your name and social security number exactly as they appear on your Form IT-201 or Form IT-203. If applicable, include your spouse's name.

- Mark the appropriate box indicating your change of resident status: New York City change, Yonkers change, or both.

- In Part 1, provide your New York adjusted gross income. Fill in the amounts received during your residency in both New York City and Yonkers.

- You must compute the New York adjustments based on your periods of residency and include them in the corresponding columns.

- In Part 2, complete the itemized deductions based on the applicable amounts for the period you were a New York City resident.

- Complete Parts 3 and 4 to calculate your dependent exemptions and the part-year New York City resident tax using the provided tax rates.

- In Part 5, if you were a Yonkers resident, complete the necessary fields to compute your part-year Yonkers resident income tax surcharge.

- Review all filled information to ensure accuracy before finalizing.

- Once completed, save your changes, download, print, or share the form as needed.

Start filling out your NY IT-360.1-I form online today!

Roth IRA or Roth 401(k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.