Get Consent To Disclosure Of Tax Return/bookkeeping Information To Third Party

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consent to Disclosure of Tax Return/Bookkeeping Information to Third Party online

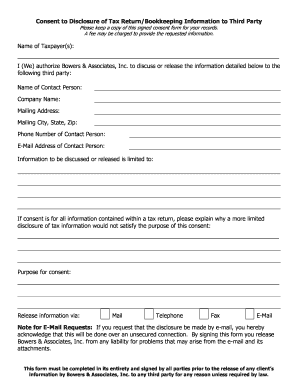

This guide is designed to help you complete the Consent to Disclosure of Tax Return/Bookkeeping Information to Third Party form online. By following these clear instructions, you will ensure that your information is shared securely and appropriately with the designated third party.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Fill in the full name of the taxpayer or taxpayers in the 'Name of Taxpayer(s)' section. This identifies who is authorizing the disclosure.

- In the section below, indicate the name of the third party that you are authorizing to receive your information. Include the 'Name of Contact Person' and 'Company Name'.

- Provide the 'Mailing Address', 'Mailing City, State, Zip', and 'Phone Number of Contact Person'. This ensures accurate communication.

- Enter the 'E-Mail Address of Contact Person' if you prefer that information be sent electronically. Note the warning about unsecured connections.

- Specify the information you are allowing to be discussed or released. If you are permitting access to all information in your tax return, explain why limited disclosure would not suffice.

- In the 'Purpose for consent' section, clarify why you are granting this permission. This provides context for the disclosure.

- Select your preferred method for releasing information from the available options: Mail, Telephone, Fax, or E-Mail.

- Indicate the expiration date for this consent. If not specified, the consent is valid for one year from the signing date.

- Ensure all parties sign and print their names where required. This includes anyone authorized, and signatures must be dated.

- Once you have completed the form, save your changes, download a copy for your records, or print it for submission.

Complete your documents online to ensure fast and secure processing!

Authorization to release tax information to a third party is a formal agreement that allows a designated individual to receive your tax information from the IRS. By completing a Consent to Disclosure of Tax Return/Bookkeeping Information to Third Party, you specify who can access your information and for what purpose. This process helps maintain your privacy while enabling trusted individuals to help you with tax-related matters.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.