Get Certificate Under Section 109

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Under Section 109 online

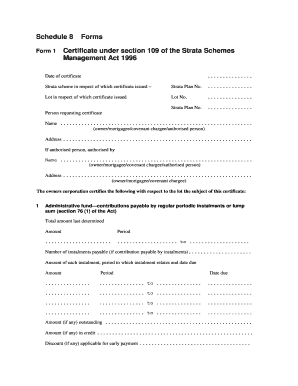

Filling out the Certificate Under Section 109 is an essential step for strata schemes to provide necessary information about lot contributions and management. This guide will walk you through each component of the form online, ensuring you complete it accurately and efficiently.

Follow the steps to complete your Certificate Under Section 109.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter the date of the certificate at the top of the form. Ensure this reflects the current date for accuracy.

- Provide details of the strata scheme. Fill in the Strata Plan Number that corresponds to the certificate being issued.

- Input the lot number pertaining to the certificate. Make sure to include the correct Strata Plan Number associated with this lot.

- Identify the person requesting the certificate. Enter the full name and address of the owner, mortgagee, covenant chargee, or authorized person.

- If applicable, record the name and address of the authorized person who is requesting the certificate.

- Complete the sections regarding administrative fund contributions, including the total amount last determined, the period, and any amounts outstanding or in credit.

- Fill out the sinking fund details similarly, ensuring to capture all necessary contribution amounts and schedules.

- Provide information on special contributions, unpaid amounts under by-laws, contributions towards costs of proceedings, and any other relevant financial details as specified in the form.

- List particulars on the strata roll, including the owner's name and address for notices, as well as any relevant mortgagee information.

- Document any insurance policies held by the owners' corporation that are relevant to the certificate.

- Continue filling out any additional sections that apply to your situation, including contributions payable to community associations, building management committees, or any other specified persons or bodies.

- Review all sections for completeness and accuracy. Once satisfied, you can save changes, download, print, or share the completed Certificate Under Section 109.

Begin filling out your documents online today for a streamlined experience.

Section 109 of the Internal Revenue Code specifically addresses tax treatment for certain types of income and non-taxable exchanges. Understanding this section can greatly benefit individuals filing their taxes, as mistakes can lead to penalties. It is advisable to explore this code thoroughly to make informed decisions. For further reassurance, you can seek a Certificate Under Section 109 for your tax documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.