Get Branch Team Mortgage Prequalification Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Branch Team Mortgage Prequalification Worksheet online

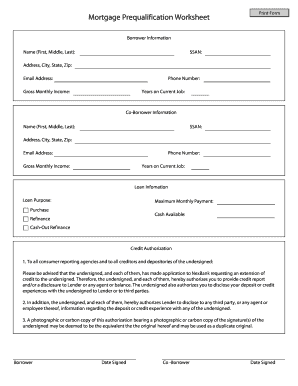

The Branch Team Mortgage Prequalification Worksheet is a crucial document for individuals seeking to determine their eligibility for a mortgage. This guide provides straightforward, step-by-step instructions for successfully completing the worksheet online.

Follow the steps to complete your mortgage prequalification worksheet.

- Click ‘Get Form’ button to access the worksheet and open it in your preferred editor.

- Begin by entering the borrower information. Fill in your name (first, middle, last), social security number (SSAN), address including city, state, and zip code, email address, and phone number. Provide the gross monthly income and the number of years you have been on your current job.

- Next, enter the co-borrower information if applicable. Repeat the same details: name (first, middle, last), SSAN, address, email, phone number, gross monthly income, and years on current job.

- Proceed to the loan information section. Indicate the loan purpose by selecting ‘Purchase’, ‘Refinance’, or ‘Cash-Out Refinance’. Input your maximum monthly payment and cash available for the transaction.

- For the credit authorization section, review the authorization terms carefully. Ensure you understand the implications before providing your consent by signing in the designated space, along with the co-borrower if applicable, and enter the date signed.

- Once all information is filled out accurately, save your changes. You can then download, print, or share the completed form as needed.

Complete your Branch Team Mortgage Prequalification Worksheet online today!

To get a prequalification for a mortgage, start by filling out the Branch Team Mortgage Prequalification Worksheet. This document requires information about your income, debt, and credit to assess your borrowing potential. Once submitted, your lender will review the details and give you feedback on your prequalification status. Following this process empowers you with the knowledge and confidence needed for your home search.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.