Loading

Get 2006-2007 Verification Worksheet Federal Student Aid Programs Dependent You Application Was

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006-2007 Verification Worksheet Federal Student Aid Programs Dependent You application online

Completing the 2006-2007 Verification Worksheet is a vital step in verifying your financial information for Federal Student Aid programs. This guide provides a clear, step-by-step approach to help you accurately fill out the form online.

Follow the steps to complete your verification worksheet effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

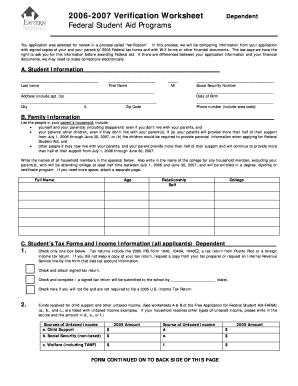

- Begin by entering your student information in section A. Fill in your last name, first name, middle initial, and social security number. Then, provide your full address, including apartment number, city, state, zip code, and phone number.

- Proceed to section B, which requires you to list the family members in your parent’s household. Include yourself, your parent(s), your siblings, and any other individuals your parents support. Specify their names, ages, relationships, and the college they will attend if applicable.

- In section C, provide your tax forms and income information. Check one box to indicate whether you have filed your tax return, will submit your tax return, or are not required to file. If applicable, report any untaxed income you received, such as child support, social security income, or welfare.

- If you did not file a tax return, list your employer and any income received in 2005. Ensure you enter '0' if you had no income to avoid delays. Include any income exclusions received during 2005 in the designated area.

- In section D, repeat similar steps for your parent(s)’ tax forms and income information. They need to check the corresponding box about their tax return status and provide any necessary information related to untaxed income and exclusions.

- Finally, sign the worksheet in section E. Both the student and at least one parent must sign and date the form to certify that all information provided is accurate and complete.

- Once you have filled out the worksheet completely, save your changes. You may choose to download, print, or share the form as necessary before submitting it to the designated financial aid office.

Start completing your verification worksheet online today!

Typically, dependent students are under 24 years old, unmarried, without dependents, and not veterans or active duty members of the U.S. armed forces. If a student is considered dependent, their eligibility for financial aid will depend on their family's income, assets, and their own.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.