Loading

Get Irs Due Diligence Verification Document 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Due Diligence Verification Document online

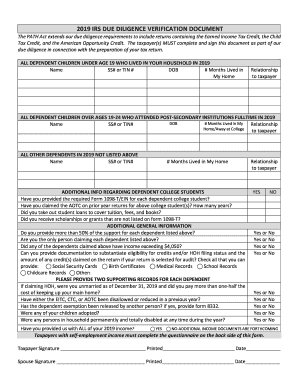

The IRS Due Diligence Verification Document is essential for taxpayers claiming specific credits. This guide provides step-by-step instructions on how to fill out the form accurately online to ensure compliance with IRS guidelines.

Follow the steps to complete the IRS Due Diligence Verification Document online.

- Click the ‘Get Form’ button to obtain the form and open it in an online editor.

- Begin by entering information for all dependent children under age 19 who lived in your household in 2019. Provide their name, Social Security Number (SSN) or Tax Identification Number (TIN), date of birth (DOB), number of months they lived in your home, and their relationship to you.

- Next, input details for all dependent children aged 19-24 who attended post-secondary institutions full-time in 2019. Include their name, SSN or TIN, DOB, number of months they lived in your home or away at college, and their relationship to you.

- List any other dependents not previously mentioned. Fill in their name, SSN or TIN, and the number of months they lived in your home.

- Answer the additional questions regarding dependent college students. Indicate whether you have provided the required Form 1098-T/EIN for each student, claimed the American Opportunity Tax Credit (AOTC) in prior years, took out student loans, and received any scholarships or grants not reported on Form 1098-T.

- Complete the general questions about your support for each dependent, whether you are the only person claiming them, and if any dependents had an income exceeding $4,050. Check the documentation you can provide to substantiate the credits you're claiming.

- If claiming Head of Household status, confirm your marital status and that you covered more than half the costs of maintaining your main home. Answer questions regarding the disallowance of credits in previous years and if any dependents were adopted.

- For taxpayers with self-employment income, answer the relevant questions regarding your business ownership, types of records maintained, and Forms 1099-MISC.

- Finally, ensure that you or your partner sign and date the form. Review all entries for accuracy before saving your changes, downloading, printing, or sharing the form.

Complete your IRS Due Diligence Verification Document online today to ensure compliance and accuracy in your tax filing.

Related links form

Due Diligence Examples Listed are several diligence examples of usage: Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment. An underwriter auditing an issuer's business and operations prior to selling it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.