Loading

Get Tx Vtr-62-a 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX VTR-62-A online

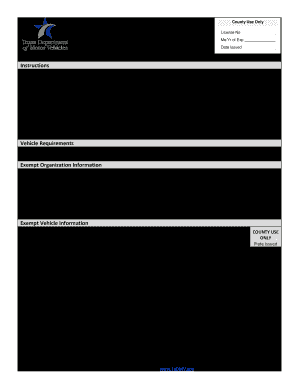

The TX VTR-62-A form is essential for governmental entities seeking standard exempt license plates for their vehicles. This guide provides clear steps to help you complete the form online accurately and efficiently.

Follow the steps to complete the TX VTR-62-A application seamlessly.

- Click ‘Get Form’ button to obtain the application form and open it in the editor.

- Begin by entering the information for the Exempt Organization, including the name of the governmental entity, the authorized agent's first, middle, and last name, as well as their suffix if applicable. Fill in the office or department, address, city, state, email, ZIP code, and phone number.

- For the Exempt Vehicle Information section, provide details such as the year model, vehicle make, body style, vehicle identification number, and the empty weight in pounds.

- If applying for multiple vehicles, ensure to complete the fields for each one listed under the County Use Only section. You can list up to six vehicles on this form.

- Read the certification statement carefully, as it contains important legal information. By signing, you affirm that you are authorized to submit this application on behalf of the governmental entity and that the vehicle(s) reflect the entity's name as required.

- Once you have filled out all the required fields and reviewed your information for accuracy, you can save your changes. The form provides options to download, print, or share it as needed for submission.

Complete your TX VTR-62-A application online today for efficient processing.

Unlike in some places where letters can represent either year of issue or county, in Texas, the letters have no significant meaning. The letters are simply used to increase the number of possible plates, since Texas is such a large state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.