Loading

Get Nm Trd Pit-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD PIT-1 online

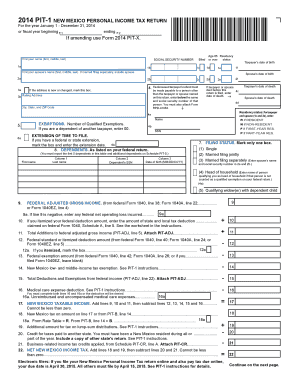

Filling out the NM TRD PIT-1 online can streamline your personal income tax return process and ensure you meet filing requirements conveniently. This guide provides you with step-by-step instructions to assist you in completing the form accurately.

Follow the steps to complete your NM TRD PIT-1 online.

- Click ‘Get Form’ button to access the NM TRD PIT-1 form and open it for completion.

- Begin by entering your name in the designated fields as specified at the top of the form. Provide your first, middle, and last name.

- If applicable, fill in your Social Security number and date of birth in the corresponding fields to identify yourself.

- Provide your residency status by marking 'R' for resident, 'N' for non-resident, 'F' for first-year resident, or 'P' for part-year resident according to your situation.

- If you are married and filing separately, include your spouse's name and Social Security number in the respective fields.

- Next, indicate your mailing address, ensuring to mark if the address has changed in the corresponding box.

- Complete the exemptions section by indicating the number of qualified exemptions you are claiming.

- Indicate your filing status by marking one of the provided options: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Input your federal adjusted gross income and any applicable deductions or additions based on the instructions provided in the form.

- Continue filling out the tax sections, including any credits, taxes, and payments, ensuring accuracy in all calculations.

- Once all sections are completed, review carefully for any errors or omissions.

- Finally, save your changes, and choose to download, print, or share your completed form as appropriate.

Complete your NM TRD PIT-1 online for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

New Mexico Tax Brackets for Tax Year 2022 Any income over $157,500 (Single), or $315,000 (Married) would be taxes at the highest rate of 5.90%. Taxes Due:$7,513.50 plus 5.9% over $157,500. Taxes Due:$15,027 plus 5.9% over $315,000.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.