Loading

Get Au Nat 71161 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 71161 online

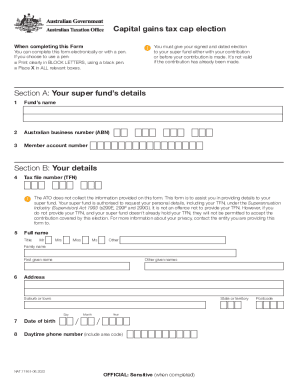

Filling out the AU NAT 71161 form is essential for making a capital gains tax cap election related to your superannuation contributions. This guide offers step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the AU NAT 71161 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In Section A, fill out your super fund's details: Provide the fund's name, the Australian business number (ABN), and your member account number.

- In Section B, enter your details: Insert your tax file number (TFN), full name (including title, family name, and first given name), other given names, address, suburb or town, state or territory, date of birth, and daytime phone number.

- In Section C, complete the payer details: Indicate the payer's name, ABN, contact name (including title, family name, and first given name), and contact phone number.

- In Section D, make your election: Select the appropriate box(es) for the capital gains tax (CGT) concession that applies to you and provide the amount you wish to exclude from your non-concessional contributions cap.

- For further contributions under a look-through earnout right, answer the question regarding whether this election pertains to such contributions by selecting 'Yes' or 'No'.

- In Section E, complete the declaration: Confirm that you meet the eligibility requirements and that all information provided is true and correct by signing and dating this section.

- Once all sections are filled out, you can save changes, print, or share your completed form as needed.

Complete the AU NAT 71161 form online to ensure your capital gains tax cap election is accurately submitted.

This amount counts towards an individual's lifetime CGT cap of $1.705 million (2023/24). The $500,000 retirement exemption only relates to exempt capital gains and not the total proceeds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.