Loading

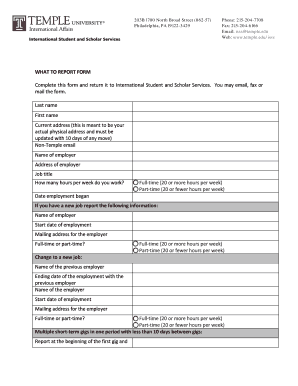

Get What To Report Form Complete This Form And Return It To ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WHAT TO REPORT FORM Complete This Form And Return It To ... online

Filling out the WHAT TO REPORT FORM is an essential task for maintaining your compliance with reporting requirements. This guide offers a clear, step-by-step approach to help you accurately complete the form and return it online.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering your last name and first name in the designated fields.

- Provide your current physical address. This must be updated within 10 days of any change of address.

- Input your non-University email address for communication purposes.

- Fill in the name and address of your employer, along with your job title.

- Indicate how many hours you work per week by choosing either 'Full-time (20 or more hours per week)' or 'Part-time (20 or fewer hours per week)'.

- Record the date your employment began.

- If you have a new job, provide the name of your new employer, the start date of your employment, and the mailing address for the employer.

- Again indicate whether this new position is full-time or part-time.

- If changing jobs, document the name of your previous employer, the ending date of your previous employment, and the details of your new employer as specified in previous steps.

- For multiple short-term gigs, indicate 'Multiple short-term gigs' at the beginning of your first gig and include the respective details.

- If you are self-employed, provide the relevant start and end dates of your contracts.

- In case of more than 10 days of unemployment, specify 'unemployed' and the ending date of your last job.

- If you are a self-employed business owner, indicate the date you started or closed your business.

- If you are completing OPT and exiting the United States, indicate this status as necessary.

- Once completed, make sure to save your changes, download a copy, or share the form as required.

Complete the WHAT TO REPORT FORM online today to ensure your compliance with reporting requirements.

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.