Loading

Get Accepted Forms And Schedules For Forms 1065/1065-b 2013-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Accepted Forms and Schedules for Forms 1065/1065-B online

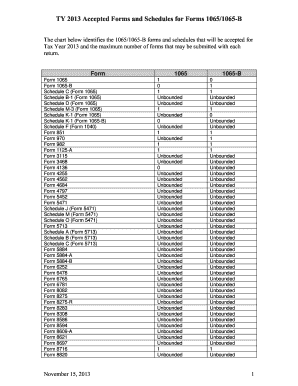

Filling out the Accepted Forms and Schedules for Forms 1065 and 1065-B online can be a straightforward process with the right guidance. This guide will help you understand each section of the forms while providing step-by-step instructions tailored to your needs.

Follow the steps to complete your forms effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your digital editor.

- Review the form thoroughly, taking note of any specific instructions or requirements for each section.

- Begin filling out Form 1065 or Form 1065-B by entering the basic identifying information, such as the partnership's name, address, and tax identification number.

- Proceed to complete the appropriate schedules relevant to your filing situation, such as Schedule B or Schedule K-1, ensuring all details correspond to the entity's financial activities.

- Input any additional forms that may be required based on your situation, such as Form 8824 or Form 8865, ensuring that the total number does not exceed the limits set for each return.

- Once all required fields and schedules are accurately filled, carefully review the information for completeness and accuracy.

- After confirming that all entries are correct, save your changes and choose your preferred options to download, print, or share the form.

Start filling out your forms online today for a smoother filing experience.

Schedule B provides detailed information about interest and dividend income, but it can also refer to specific information required for partnerships in Form 1065. This schedule includes critical questions about ownership interests and capital contributions. Being informed about Schedule B can enhance your understanding of the Accepted Forms and Schedules for Forms 1065/1065-B.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.