Get Va Form 762b - Frederick County 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form 762B - Frederick County online

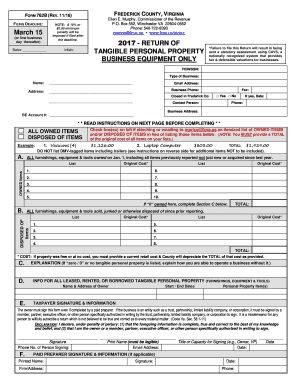

Filling out VA Form 762B is an essential step for businesses to report their tangible personal property in Frederick County. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users can navigate the process with confidence.

Follow the steps to complete your VA Form 762B online.

- Click ‘Get Form’ button to access the VA Form 762B and open it for completion.

- Fill in the FEIN/SSN field at the top of the form. This identification number is important for tracking and filing your return correctly.

- Check the box indicating whether your business closed in Frederick County. If applicable, include the date of closure and provide the contact person’s information.

- List all owned tangible personal property in Section A. Include every item with its original cost. If you have many items, consider attaching an itemized list instead.

- In Section B, enumerate any items that have been disposed of since the last filing. This helps maintain accurate records of your business assets.

- If you have no tangible personal property, provide an explanation in Section C detailing how your business operates without it.

- For Section D, report any leased, rented, or borrowed property. Include the names and addresses of the owners, along with the specifics of the items and associated dates.

- Complete Section E with your signature and information as the business owner or authorized signer. This step confirms that the information provided is true and accurate.

- If applicable, Section F should be filled out by the paid preparer. This includes their signature and contact information.

- Once all sections are completed, review the form for accuracy. Save your changes and proceed to download, print, or share the form as needed.

Take your time to complete the VA Form 762B accurately and submit it online for your business needs.

Get form

You can obtain a PA 40 form, which is the Pennsylvania Personal Income Tax Return, through the Pennsylvania Department of Revenue's website. Additionally, certain third-party platforms like uslegalforms offer access to this and other tax-related documents. This can make your filing process smoother and help you gather the necessary forms, including VA Form 762B - Frederick County, if applicable.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.