Loading

Get State Withholding Request Form - Camc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Withholding Request Form - Camc online

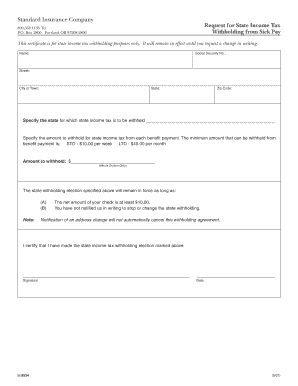

The State Withholding Request Form - Camc is an essential document for users seeking to manage their state income tax withholding from sick pay. This guide will walk you through the process of filling out the form online, ensuring that you complete each section with confidence.

Follow the steps to complete the State Withholding Request Form - Camc online.

- Press the ‘Get Form’ button to obtain the State Withholding Request Form - Camc and open it in your preferred document editor.

- Begin by entering your full name in the designated field, ensuring accuracy as it should match your identification documents.

- Provide your social security number in the appropriate section. This number is crucial for the form's processing.

- Fill in your street address, along with the city or town, state, and zip code. Ensure that the information reflects your current and correct address.

- Specify the state for which you would like state income tax to be withheld. This is important as it determines the tax regulations applicable to your situation.

- Indicate the amount you wish to withhold for state income tax from each benefit payment. Remember, the minimum withholding is $10.00 per week for short-term disability and $40.00 per month for long-term disability. Ensure this amount is in whole dollars only.

- Review the statement regarding the continuation of the withholding election. Ensure you understand that this election will remain in force unless you provide written notification to change it.

- By signing the form, you certify your understanding and agreement with the withholding election marked above. Include the date next to your signature for proper documentation.

- Once finished, you can save your changes, download a copy of the completed form, print it for your records, or share it as needed.

Complete your documents online efficiently and accurately today!

People Also Ask about indiana wh 3 What's a WH-3? The WH-3 (Annual Withholding Reconciliation Form) is a reconciliation form for the amount of state and county income taxes withheld throughout the year. All employers must file the WH-3 by January 31 each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.