Get Tx Certificate Of Appropriateness & Historic Site Tax Exemption Application 2008-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

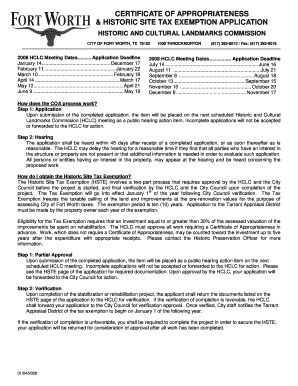

How to fill out the TX Certificate of Appropriateness & Historic Site Tax Exemption Application online

This guide provides a clear and supportive approach to completing the TX Certificate of Appropriateness and Historic Site Tax Exemption Application online. Whether you are new to the process or seeking a refresher, these step-by-step instructions will help you navigate the application effectively.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the historic property section, including the street address, city, state, zip code, legal description, lot number, block number, subdivision name, and zoning information.

- In the property owner/agent section, provide the owner's name, phone number, email address, and the address of the owner. If an agent is involved, include their information as well.

- In the proposed work section, clearly indicate whether the work involves exterior alteration, relocation, addition, demolition, new construction, or other types of work. Specify details about the work that you intend to complete.

- Complete the acknowledgements section by certifying that the provided information is correct, and understand the requirements and proceedings of the application process.

- Attach all required documentation that pertain to your proposed work, ensuring all materials are submitted in the specified formats.

- Finally, review the entire application for completeness, and then save changes, download the form, print it, or share it as necessary.

Start completing your TX Certificate of Appropriateness & Historic Site Tax Exemption Application online now!

exempt individual typically must engage in activities for a nonprofit or charitable purpose. The IRS distinguishes taxexempt organizations based on their goals and functions, which often include education, charity, or religious purposes. If you aim to apply for the TX Certificate of Appropriateness & Historic Site Tax Exemption Application, aligning your activities with these categories is crucial.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.