Loading

Get Tx C-240 Qtr 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX C-240 QTR online

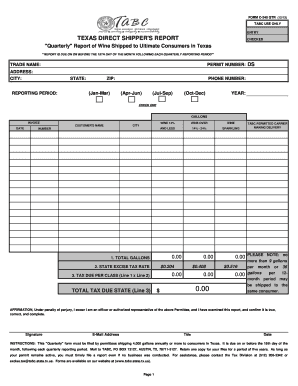

Filling out the TX C-240 QTR online is crucial for permittees shipping wine to consumers in Texas. This guide provides a detailed walkthrough of each section to ensure accurate and timely submissions.

Follow the steps to complete the TX C-240 QTR form effectively.

- Click ‘Get Form’ button to obtain the TX C-240 QTR document and open it in your preferred online editor.

- Enter your permit number in the designated field at the top of the form to confirm your authorization to ship wine.

- Fill in your trade name and address, including city, state, and zip code, to provide your business information.

- Indicate the reporting period by choosing from one of the options: January through March, April through June, July through September, or October through December.

- Provide your phone number to ensure that you can be reached if there are questions regarding your report.

- For each transaction, input the invoice date, customer's name, city, and number of gallons shipped in the respective fields.

- Categorize the gallons shipped by selecting the appropriate classes of wine over 14% and sparkling wine.

- Calculate the total gallons shipped and input them in the total gallons field.

- Enter the state excise tax rates provided on the form and calculate the tax due for each class of wine.

- Sum the tax due for all classes and enter the total tax due at the bottom of the section.

- Confirm the details with the affirmation statement, signing and dating it to validate your submission.

- Input your email address and title before finalizing the form.

- Once all information is complete, save your changes, then download, print, or share the completed form as necessary.

Ensure compliance by filing the TX C-240 QTR online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a trucking company often needs to file Form 720 if it engages in activities subject to federal excise taxes. This requirement typically applies to companies involved in fuel use or specific motor vehicle sales. Understanding these responsibilities can help trucking companies comply with federal regulations. The US Legal Forms platform offers valuable insights on navigating the TX C-240 QTR for trucking businesses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.