Get Tx 11.251 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 11.251 online

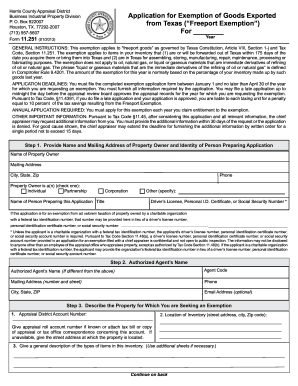

The TX 11.251 form is essential for applying for a Freeport Exemption on goods exported from Texas. This guide provides clear and supportive instructions for users to complete the form effectively, ensuring eligibility for property tax exemptions.

Follow the steps to complete the TX 11.251 form online.

- Click the ‘Get Form’ button to obtain the TX 11.251 form and start the process of filling it out.

- In the first section, provide the name and mailing address of the property owner along with the identity of the person preparing the application. Indicate their relationship status (individual, partnership, corporation, or other). Include the appropriate identification number if applicable.

- Enter the authorized agent's name, if different from the property owner. Complete the agent code and their mailing address, including phone and email if available.

- Describe the property for which you are seeking an exemption. This includes entering the appraisal district account number, the location of the inventory, and a general description of the types of items included in the inventory.

- Answer the questions related to the property’s inventory, confirming whether any portions will be transported out of state this year. Provide the total cost of goods sold and the cost of goods shipped out of Texas within the required timeframe.

- Indicate the percentage of last year’s value represented by the freeport goods and if the percentage of goods transported out of Texas this year will be significantly different from last year.

- Provide the market value of your inventory as of January 1 of this year and the value of the inventory you claim will be exempt.

- Read the certification statement, then sign and date the application. Optionally, provide an email address for further communication.

- After completing the application, save your changes. You can download, print, or share the form as necessary for submission.

Complete your TX 11.251 application online to ensure you receive your eligible Freeport Exemption for this year.

Section 11.251 of the Texas tax code outlines specific property tax exemptions available for certain properties, primarily focusing on residential homestead exemptions. This section is crucial for homeowners as it defines eligible properties and the benefits associated with the exemption. Understanding TX 11.251 can lead to significant tax savings for eligible homeowners. For assistance, consider using US Legal Forms, which provides insights into property tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.