Loading

Get Tn Dor Rv-f1301101 2008-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN DoR RV-F1301101 online

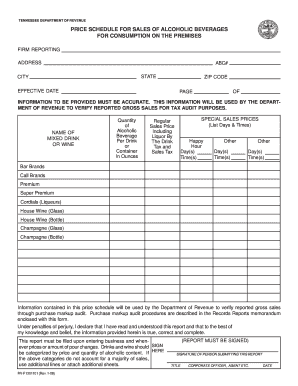

Filling out the TN DoR RV-F1301101 form is a crucial step for businesses selling alcoholic beverages for consumption on the premises. This guide provides clear instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering your firm's reporting address. This includes the company's name, street address, city, state, and zip code. Ensure all information is accurate as it is essential for tax purposes.

- Fill in the effective date of the price schedule. This date indicates when the prices listed on the form will take effect.

- List the name of each mixed drink or type of wine you are offering. Be specific to mitigate confusion during audits.

- Indicate the quantity of the alcoholic beverage per drink or container in ounces. This provides clarity on the amount you are dispensing.

- Specify regular sales prices that include applicable liquor by the drink tax and sales tax for each drink or wine listed. This information must be accurate for compliance.

- Detail any special sales prices including the days and times they occur, such as happy hour offerings. Include this information in the provided sections.

- Categorize the drinks into different classifications such as bar brands, call brands, and premium drinks. Include the corresponding prices in the designated space.

- Review your entries thoroughly to ensure that all information is correct and complete. Accuracy is vital, as this information will be used for verification by the Department of Revenue.

- Once all fields are completed and verified, you can save the changes, download the form, print it, or share it as needed. Remember to sign the report, as it is a legal requirement.

Complete your TN DoR RV-F1301101 form online today to ensure compliance and accurate reporting.

✔ Tennessee's general sales tax of 7% also applies to the purchase of liquor. In Tennessee, liquor vendors are responsible for paying a state excise tax of $4.40 per gallon, plus Federal excise taxes, for all liquor sold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.