Loading

Get Retiring Assets Automatically

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retiring Assets Automatically online

This guide provides a clear and supportive approach to completing the Retiring Assets Automatically form online. Users will find step-by-step guidance to ensure a smooth and efficient process.

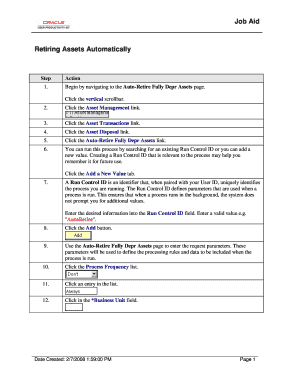

Follow the steps to successfully retire assets automatically.

- Begin by navigating to the Auto-Retire Fully Depr Assets page. Use the vertical scrollbar to find this page.

- Select the Asset Management link to access the asset management functions.

- Click on the Asset Transactions link to open the transactions section.

- Choose the Asset Disposal link to proceed to disposal options.

- Select the Auto-Retire Fully Depr Assets link to initiate the retirement process.

- You can either search for an existing Run Control ID or add a new one. To create a new Run Control ID, click the Add a New Value tab.

- Enter a unique identifier in the Run Control ID field, such as 'AutoRetire', which will be used to track the process.

- Click the Add button to save your Run Control ID.

- On the Auto-Retire Fully Depr Assets page, enter the request parameters which will set the rules for processing.

- Click the Process Frequency list to select how often the process should run.

- Choose an entry from the list to set your preferred process frequency.

- Enter the relevant information into the Business Unit field, selecting the appropriate business unit for the asset retirement.

- Ensure the Trans Date reflects that the asset is fully depreciated and ready for auto-retirement. You may keep the default value if applicable.

- Verify the Acctg Date field to confirm the accounting period for the transaction. The default value is usually suitable.

- Click the Run button to submit your request for processing.

- On the Process Scheduler Request page, enter or update fields as necessary, including server name and output format.

- Select a Server Name from the list to determine the server on which the process will run.

- Choose the AMRETFDA option to run the selection criteria for retiring the assets.

- Select the Auto-Retire Fully Depr Asset option to automatically schedule both the selection and transaction processes.

- Click the OK button to finalize your choices.

- A Process Instance number will appear. Note this number for tracking your process status.

- Click the Process Monitor link to access the status of your submitted process.

- Monitor the Process List page to see the status labeled as Processing. Refresh until it shows Success.

- Once the status indicates Success, you have successfully retired the assets automatically.

Complete your documents online with confidence and accuracy.

Related links form

Retire an asset when it is no longer in service. For example, retire an asset that was stolen, lost, or damaged, or that you sold or returned.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.