Get Oh B-11a 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH B-11A online

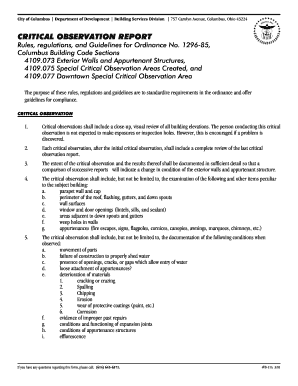

This guide provides a clear and supportive approach to completing the OH B-11A, a critical observation report for exterior walls and appurtenances of buildings. By following these steps, users can efficiently fill out the form and ensure compliance with the necessary regulations.

Follow the steps to complete the OH B-11A online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the 'Date of Submission' and 'Date of Survey' fields accurately with the respective dates.

- Provide the 'Building Name' and specify the 'Age of Building.' Ensure this information is current and accurate.

- Complete the 'Address of Building' section, including the street address, city, state, and zip code.

- Indicate the 'Number of Stories' of the building clearly.

- Select the 'Exterior Wall Construction' type by marking the relevant box and specifying 'Other' if applicable.

- Fill out the 'Floor Construction' field by marking the appropriate box and providing details for 'Other' if needed.

- Complete the 'Roof Construction' section in the same manner as floor construction.

- Provide the 'Building Owner' name and 'Telephone' number. Also, include the owner's address.

- List the 'Building Manager' name, 'Telephone Number,' and the company performing the critical observation.

- Enter the name of the 'Person Conducting Critical Observation,' along with their contact details.

- In the 'Remarks by observing person' section, provide any relevant observations or attach additional sheets if needed.

- Fill in the name and registration number of the architect or professional engineer, and the name of the person completing the report if different.

- Finally, sign and date the form to complete the submission process.

- Once all information is entered, save changes, and consider downloading or printing the form for your records or sharing as required.

Complete your OH B-11A form online today for efficient documentation.

Qualifying for the Ohio business income deduction requires reporting business income on the OH B-11A accurately. The income must be from a pass-through entity and comply with specific requirements set by the Ohio tax law. Also, certain thresholds and limitations apply, so keeping abreast of recent changes is crucial. Consider utilizing uslegalforms for concise information to navigate the requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.