Get Ny Char016a 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR016A online

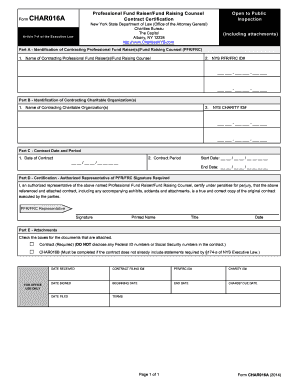

Filling out the NY CHAR016A form is an essential step for professional fundraisers and fundraising counsel to ensure compliance with New York State law. This guide will walk you through the process of completing the form online, providing clear and user-friendly instructions for each section.

Follow the steps to complete the NY CHAR016A form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, enter the name of the contracting professional fundraiser or fundraising counsel in the designated field. Be sure to include the New York State PFR/FRC ID number as prompted.

- Proceed to Part B to identify the contracting charitable organization. Fill in the name of the organization and its NYS CHARITY ID number.

- In Part C, specify the contract date and period. Input the start and end dates of your contract using the provided format.

- Part D requires the signature of an authorized representative of the fundraising counsel. Ensure to provide their printed name, title, and the date of signing in the appropriate fields.

- In Part E, check the boxes indicating the documents that are attached to your submission, including the required contract and any other necessary attachments.

- Once all sections are completed, save the changes. You can then download, print, or share the completed form as needed.

Complete your documents online to ensure compliance and streamline your filing process.

New employees in New York are required to complete several forms essential for employment compliance. Key forms include the federal W-4, the I-9 for identity verification, and state-specific documents such as the NY CHAR016A. Completing these documents accurately helps ensure that all legal requirements are met and facilitates a quicker onboarding process. Using platforms like uslegalforms can simplify this task significantly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.