Loading

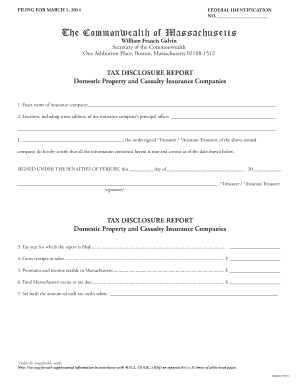

Get Filing For March 1, 2012 Federal Identification No - Sec State Ma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FILING FOR MARCH 1, 2012 FEDERAL IDENTIFICATION NO - Sec State Ma online

This guide will assist you in completing the Filing for March 1, 2012 Federal Identification No - Sec State Ma. By following these steps, you will ensure a streamlined process in fulfilling your filing obligations.

Follow the steps to accurately complete your filing online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the upper right corner, enter your Federal Identification Number (employer’s I.D.). If you do not possess one, it is required to apply to the Internal Revenue Service.

- In item 1, enter the exact name of the insurance company as stated on the Articles of Organization. Avoid using any d/b/a names or abbreviations.

- In item 2, provide the full street address of the company’s principal office, including city or town, state, and zip code.

- Complete the certification statement by inserting the name of the person completing the form, indicating if they are the treasurer or assistant treasurer, and then sign and date the document.

- In item 3, note the last day, month, and year of the tax year for which the report is being filed.

- For item 4, enter the gross receipts or sales as outlined in your company’s National Association of Insurance Commissioners Annual Statement.

- In item 5, document the premiums and income taxable in Massachusetts, as guided by Form 63-23P.

- Item 6 requires you to list the total Massachusetts excise or tax due, corresponding to the reported amounts on Form 63-23P.

- Lastly, in item 7, enter the amount of each tax credit taken against the excise, as seen on Form 63-23P.

- Once all fields are completed, ensure you save changes, and you may then download, print, or share the completed form as needed.

Start your filing process online today to ensure compliance and accuracy.

Related links form

Massachusetts corporations are the only business entities that will be assessed a late fee ($25) for failing to file an annual report. However, all companies will be administratively dissolved if they remain delinquent for two or more years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.