Loading

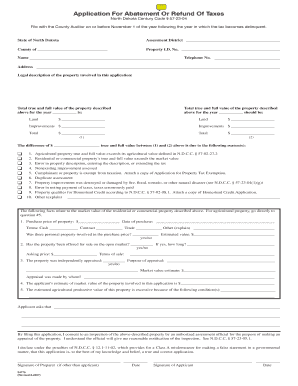

Get Application For Abatement Or Refund Of Taxes North Dakota Century Code 57-23-04 File With The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Application For Abatement Or Refund Of Taxes North Dakota Century Code 57-23-04 File With The online

This guide provides detailed, step-by-step instructions on how to complete the Application For Abatement Or Refund Of Taxes under North Dakota Century Code 57-23-04. By following these instructions, users can efficiently fill out the necessary form online and submit it as required.

Follow the steps to fill out the application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the assessment district and the county of the property. Provide necessary details such as the Property I.D. No. and your name.

- Enter your telephone number and complete your address, ensuring accuracy to avoid any issues with communication.

- Provide the legal description of the property involved in the application, followed by the total true and full value of the property for the previous year and the current year.

- State the reason for the difference in property values by checking the applicable reasons listed. You may elaborate on reasons not covered in the options provided.

- For residential or commercial properties, provide details related to the market value such as purchase price, terms of sale, and whether the property has been appraised.

- Indicate your estimate of the market value and the reasons if the agricultural productive value is excessive.

- Sign the application with your name and date. If someone else prepared the application, they must also sign it.

- Obtain the recommendation of the governing body of the city or township and include their resolution regarding your application.

- Once completed, save your changes. Review the form for accuracy, then proceed to download, print, or share the application as necessary.

Ensure your application is completed and submitted online accurately to facilitate the tax abatement or refund process.

The refund request must be submitted within three years of the sale invoice or receipt date. An electronic or paper copy of the sale invoice or receipt must be submitted with the refund request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.