Loading

Get Nh Schedule C 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH Schedule C online

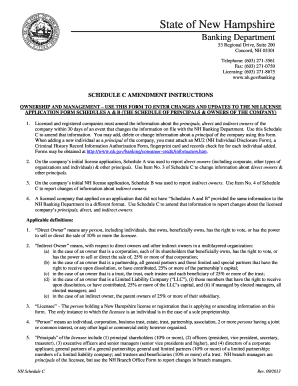

Filling out the NH Schedule C is an important step for licensed and registered companies in New Hampshire to update their licensing information effectively. This guide provides clear and supportive instructions to help users navigate the process with ease.

Follow the steps to complete the NH Schedule C online.

- Click ‘Get Form’ button to access the NH Schedule C form and open it in your editor.

- Review the form carefully. Begin by entering the licensee or registrant's full legal name at the top section of the form.

- In the 'Effective Date' field, insert the date on which the changes are to be effective. This is crucial for accurate record-keeping.

- Navigate to the Type of Amendment ('Type of Amd.') column. Indicate the nature of your amendment by marking ‘A’ for addition, ‘D’ for deletion, or ‘C’ for a change.

- For changes to Schedule A (Direct Owners and other Principals), provide the full legal names of individuals affected, as well as their title or status, percentage of ownership, and relevant tax identification numbers in the specified columns.

- For changes to Schedule B (Indirect Owners), similar to Schedule A, list the full legal names, the entities in which they own an interest, their status, percentage of ownership, and tax identification details.

- Once you have completed all sections, double-check the entries for accuracy and completeness to avoid delays in processing.

- Save your changes to the form. After that, you can download, print, or share the completed NH Schedule C as needed.

Take the next step towards updating your licensing information by filling out the NH Schedule C online today.

Related links form

You can find NH tax forms, including the Schedule C, on the New Hampshire Department of Revenue Administration website. Alternatively, the US Legal Forms platform provides quick access to a variety of tax forms, ensuring you have the latest versions at your fingertips.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.