Loading

Get Nh Llc-7 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH LLC-7 online

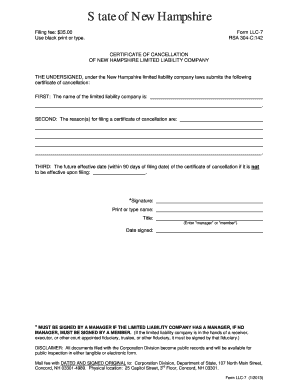

The NH LLC-7 is a crucial document for the cancellation of a limited liability company in New Hampshire. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to successfully complete the NH LLC-7 form online.

- Press the ‘Get Form’ button to access the NH LLC-7 form and open it in your browser.

- In the first section, input the exact name of the limited liability company as recorded in the official documents.

- In the second section, state the reason(s) for filing the certificate of cancellation. This could include reasons such as the company no longer conducting business or other relevant factors.

- In the third section, specify the future effective date of the cancellation, if you want it to be effective at a later date within 90 days of the filing date. If it should be effective upon filing, leave this section blank.

- Ensure that the form is signed by a manager if the limited liability company is managed by one; otherwise, it should be signed by a member. Include the printed name, title (manager or member), and the date signed.

- Once all sections are filled out correctly, you can save changes, download, print, or share the form as necessary.

Complete your NH LLC-7 form online today to facilitate the cancellation of your limited liability company.

In New Hampshire, the self-employment tax rate generally reflects the combined Social Security and Medicare tax rates, which currently total 15.3%. This tax applies to your net earnings from self-employment, including income derived from your NH LLC-7. Being aware of this rate helps ensure you can adequately prepare for tax time and minimize any anxiety about your financial obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.