Loading

Get Git-rep-3 Seller's Residency Certification/exemption - State Of New ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GIT-REP-3 Seller's Residency Certification/Exemption - State Of New Jersey online

Completing the GIT-REP-3 Seller's Residency Certification/Exemption form online can be a straightforward process with the right guidance. This guide aims to provide clear, step-by-step instructions for filling out each section of the form to ensure accurate and efficient completion.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

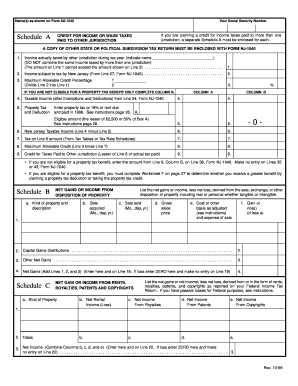

- Begin by entering your name(s) as shown on Form NJ-1040. This ensures that your identification is consistent across tax documents.

- Input your Social Security Number in the designated field. This information is crucial for processing your residency certification.

- If applicable, include a separate Schedule A for each additional jurisdiction where you are claiming a credit for income taxes paid. Make sure to provide detailed entries for each jurisdiction.

- For the credit for income or wage taxes paid to another jurisdiction, list the income being taxed by that jurisdiction on Line 1. Remember that this should not exceed the income subject to tax by New Jersey as shown on Line 2.

- Calculate the maximum allowable credit percentage by dividing Line 1 by Line 2. Ensure your calculations are accurate to avoid issues with your submission.

- If you do not qualify for a property tax benefit, complete only Column B. If you are eligible, provide the necessary information in both columns.

- Complete the taxable income entry based on your exemptions and deductions taken from Line 34 of Form NJ-1040.

- Calculate the tax on your taxable income using the appropriate tax tables or schedules.

- Determine the maximum allowable credit by multiplying your credit percentage by the calculated tax amount.

- Input the credit for taxes paid to another jurisdiction, taking the lesser amount from Line 8 or your actual tax paid.

- For those eligible for a property tax benefit, complete Worksheet F to evaluate whether it's more beneficial to claim a property tax deduction or a credit.

- Finally, review all entered information for accuracy. You can now save changes, download, print, or share the completed form.

Take the next step to complete your GIT-REP-3 form online for a seamless tax experience.

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.