Loading

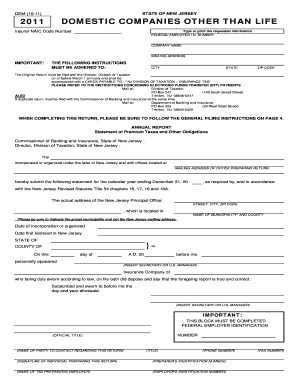

Get Dem-(10-11) State Of New Jersey 2011 Domestic Companies Other Than Life Type Or Print The Requested

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DEM-(10-11) STATE OF NEW JERSEY 2011 DOMESTIC COMPANIES OTHER THAN LIFE Type Or Print The Requested online

Completing the DEM-(10-11) form is essential for ensuring compliance with tax obligations for domestic companies in New Jersey. This guide provides clear instructions on how to fill out the form accurately and effectively, helping users navigate through the required fields with ease.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to access the form for your completion.

- Fill in the insurer NAIC code number at the top left of the first page. Ensure this five-digit code is accurate, as it is required for all taxpayers.

- Enter the federal employer identification number in the designated field. This number is important for tax reporting purposes.

- Provide the company name clearly in the designated section of the form.

- Fill in the mailing address, ensuring that you include the street, city, state, and ZIP code accurately.

- Complete the important sections regarding the date of incorporation and the date first licensed in New Jersey. This information is required for proper processing.

- For the section on taxes, fill out Schedule A. This includes entering direct premiums, dividends, and taxable premiums. Carefully calculate the rates as detailed in the instructions provided on the form.

- Proceed to complete Schedule B if applicable. This section is crucial for those electing to calculate taxable premiums under specific limitations.

- Review all fields to ensure accuracy and completeness. Pay careful attention to any documentation requirements, especially those regarding credits and additional schedules.

- Once you have filled out the form, save your changes. You can then download it, print it, or share it as needed for your records or submission.

Start completing your documents online today to ensure prompt filing and compliance.

SaaS is exempt from sales and use tax in New Jersey unless it meets the definition of an information service. SaaS is not considered a transfer of tangible personal property and is not an enumerated taxable service. New Jersey statutes and regulations do not specifically address the taxability of cloud computing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.