Loading

Get Credit Calculation For Investment In Qualified Equipment In - Newjersey

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

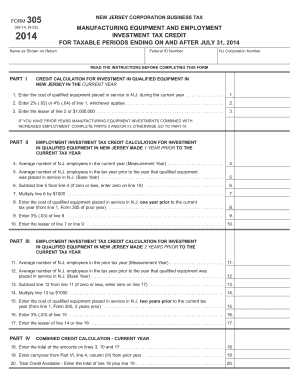

How to fill out the CREDIT CALCULATION FOR INVESTMENT IN QUALIFIED EQUIPMENT IN - New Jersey online

This guide provides clear instructions on how to accurately fill out the Credit Calculation for Investment in Qualified Equipment in New Jersey form. By following these steps, users can navigate the process effectively and ensure they meet all requirements.

Follow the steps to successfully complete your form.

- Press the ‘Get Form’ button to obtain the CREDIT CALCULATION FOR INVESTMENT IN QUALIFIED EQUIPMENT IN - New Jersey form and open it in your selected editing tool.

- Begin by entering the name as shown on the tax return in the designated field.

- Next, input your Federal ID number in the corresponding section.

- Provide your New Jersey Corporation number as required.

- Read the instructions carefully before completing the form to ensure accuracy.

- In Part I, enter the cost of the qualified equipment placed in service in New Jersey during the current year.

- Calculate 2% or 4% of the amount from the previous line, depending on which rate applies to your situation, and enter that value.

- Fill in the lesser value between the amount from the previous step or $1,000,000 in the next field.

- Proceed to Part II, where if applicable, enter the average number of New Jersey employees currently employed.

- Then, enter the average number of employees for the tax year prior to when the qualified equipment was placed in service.

- Subtract the prior year’s average from the current year’s average number of employees. If the result is zero or less, enter zero.

- Multiply this amount by $1,000 for the next calculation.

- In the following fields, enter the cost of the qualified equipment placed in service in New Jersey one year prior to the current tax year.

- Calculate 3% of this one-year prior amount and record it.

- Enter the lesser of the amounts from the previous two steps.

- Repeat a similar process in Part III if applicable for investments from two years prior.

- In Part IV, enter the total of amounts calculated from parts I, II, and III.

- Include any applicable credit carryover from previous years.

- In Part V, calculate your tax liability and ensure it meets the minimum requirements.

- Finally, save your changes, download the document, or print to have a physical copy.

Complete your documents online and take advantage of available credits!

investment credit, tax incentive that permits businesses to deduct a specified percentage of certain investment costs from their tax liability, in addition to the normal allowances for depreciation (q.v.).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.