Get Ma C110hs3 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

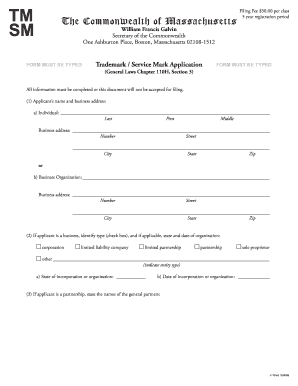

How to fill out the MA c110hs3 online

Filling out the MA c110hs3 trademark/service mark application online is a straightforward process that requires attention to detail. This guide will help users understand each section of the form, ensuring that all required information is accurately completed.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the applicant's name and business address. Indicate whether the applicant is an individual or a business organization, and provide the corresponding details including last name, first name, middle name, and business address.

- If the applicant is a business, identify the type by checking the appropriate box. Additionally, provide the state of incorporation or organization and the date of incorporation or organization.

- If the applicant is a partnership, list the names of the general partners in the respective section.

- Specify whether you are seeking to register a trademark or a service mark by checking the corresponding box.

- Describe the mark being registered. Complete one of the provided options based on whether the mark consists of words only, design only, or a combination of both, and provide details as requested.

- Briefly describe the goods or services associated with the mark. Provide information about the class in which such goods or services fall, referring to the attached classification schedule if necessary.

- Explain how the mark is used in connection with the goods or services. Indicate the manner of displaying the mark by checking the relevant boxes.

- State when the trademark or service mark has been first used, including both the general use date and the date in Massachusetts.

- Respond to questions regarding prior applications for the same mark. Indicate whether an application has been filed with the U.S. Patent and Trademark Office, and provide details if applicable.

- Attach a sample showing the mark as actively used, ensuring it does not exceed 3” x 3”.

- Complete the declaration by providing the name of the person verifying the application, executing the document with the date and signature.

- After filling out all sections, review the form for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your MA c110hs3 application online today and secure your trademark or service mark.

Related links form

Yes, businesses in Massachusetts often need to file an annual report. This requirement helps maintain your business entity's compliance with state laws. If you're operating under a structure that necessitates it, addressing your MA c110hs3 obligations ensures you stay in good standing. Utilizing platforms like US Legal Forms provides resources to assist you in meeting these requirements efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.