Loading

Get Ks Cf 51-01 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS CF 51-01 online

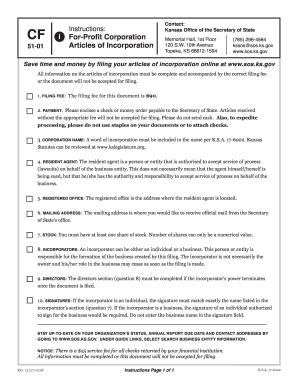

Filling out the KS CF 51-01 is a crucial step in establishing your for-profit corporation in Kansas. This guide provides easy-to-follow instructions to help you successfully complete the form online.

Follow the steps to complete your articles of incorporation online.

- Click the ‘Get Form’ button to access the KS CF 51-01 and open it in your browser.

- Enter the name of your corporation in the designated field, ensuring it includes a word of incorporation as required by Kansas law.

- Provide the name of your resident agent along with the street address of the registered office in Kansas. Note that a P.O. box is not acceptable.

- Fill in the mailing address where you would like to receive official communications from the Secretary of State's office.

- Indicate your corporation's tax closing month in the specified section.

- Describe the nature of your corporation's business, making sure to articulate the purpose clearly.

- Specify the total number of shares your corporation is authorized to issue, including details about each class and par value or other relevant designations.

- List the name and mailing address of each incorporator. If more space is needed, attach additional sheets.

- Complete the section on the board of directors, ensuring this is filled if the incorporator's power terminates once the form is filed.

- Provide the duration of the corporation and the effective date of incorporation. If selecting a future date, ensure it is within 90 days.

- Sign the form in the signature fields provided, making sure signatures match the names listed in the incorporator section. Include the corresponding dates.

- Review all fields to ensure accuracy and completeness before proceeding to submit the form. You can save changes, download, print, or share the form as needed.

Complete your articles of incorporation online today to establish your business efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Choosing between an S Corp and an LLC depends on your business goals and structure. An S Corp can offer tax advantages at higher income levels, while an LLC provides flexibility in management and taxation. Analyzing your financial situation alongside the KS CF 51-01 can help you make an informed decision that best suits your needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.