Loading

Get Fl Cr2e006 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL CR2E006 online

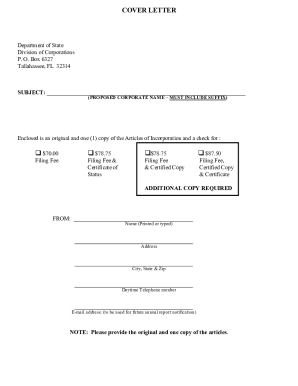

Filling out the FL CR2E006 form, which is essential for registering a not-for-profit corporation in Florida, can be straightforward when approached systematically. This guide provides a clear process for completing the form online, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete the FL CR2E006 form.

- Click the ‘Get Form’ button to access the FL CR2E006 form and open it in your preferred online editor.

- In Article I, enter the name of the corporation, ensuring it includes an appropriate corporate suffix such as Corporation, Corp., Incorporated, or Inc.

- In Article II, provide the principal place of business along with the mailing address for the corporation. Remember that the principal address must be a street address, while a P.O. Box can be used for the mailing address if different.

- For Article III, clearly state the specific purpose or purposes for which your corporation is organized. Avoid vague phrases and be as detailed as possible.

- In Article IV, describe how the directors will be elected or appointed, providing a comprehensive explanation.

- Article V requires listing the names, addresses, and titles of at least three Directors or Officers of the corporation. If necessary, provide additional information for other officers as well.

- In Article VI, fill in the name and Florida street address of the initial Registered Agent. The Registered Agent must sign and provide their printed name in the designated space.

- Article VII requests the name and address of the Incorporator, who is responsible for submitting the Articles of Incorporation.

- If you wish to establish an Effective Date for the corporation that deviates from the filing date, note it in Article VIII. Ensure it adheres to statutory requirements.

- Finally, both the Registered Agent and the Incorporator must sign and date the form, affirming that the information provided is accurate.

- After completing the form, review all entries for accuracy, then save your changes, and download, print, or share the completed FL CR2E006 form as needed.

Start completing your documents online today!

Filing articles of incorporation for a nonprofit involves submitting your completed documents to the appropriate state agency, usually the Secretary of State. Make sure to follow the specific filing procedures for your state, as these can differ. US Legal Forms offers a streamlined platform that guides you through the filing process for FL CR2E006, ensuring all forms are correctly completed and submitted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.