Loading

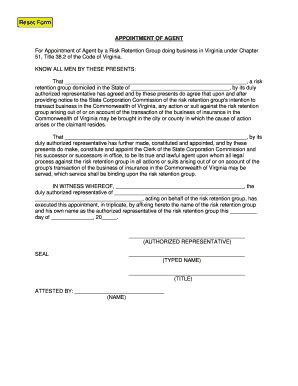

Get Risk Retention Registration Packet - Virginia State Corporation ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Risk Retention Registration Packet - Virginia State Corporation online

This guide provides clear, step-by-step instructions on how to fill out the Risk Retention Registration Packet for Virginia's State Corporation Commission online. By following these instructions, users will be able to effectively complete the required documentation for their risk retention groups.

Follow the steps to complete your registration packet effectively.

- Begin by locating and pressing the ‘Get Form’ button to access the Risk Retention Registration Packet in a suitable editor.

- Carefully review the introductory information in the packet to understand the registration requirements and purpose of the document.

- Begin filling out the application by providing a copy of the application submitted to your state of domicile, including any feasibility study or plan of operations.

- Include a statement of registration that designates the Clerk of the Commission as the agent for receiving legal documents or processes.

- Specify the state where your risk retention group is chartered and licensed as a liability insurance company, and provide a copy of the group’s license.

- Attach a certified copy of your group’s financial statement submitted to your state of domicile, along with a statement of opinion on loss and loss adjustment expense reserves.

- Provide a certified copy of each examination of the risk retention group as certified by the responsible public official.

- Enter the NAIC number assigned to your group in the state of domicile.

- Fill in the Employer Identification Number (EIN) for your risk retention group.

- Review all entries for accuracy and completeness, then proceed to save your changes, download the document, or print it for submission.

Complete your Risk Retention Registration Packet online today to ensure compliance with Virginia’s regulations.

Traditional insurance plans are designed to cover as many people as possible. But these plans tend to be generic and their coverage can be limited to only certain types of risk. On the other hand, captive insurance provides increased flexibility and customization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.