Loading

Get 40076 Non Or Part-year Resident Utah Income Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 40076 Non Or Part-year Resident Utah Income Schedule online

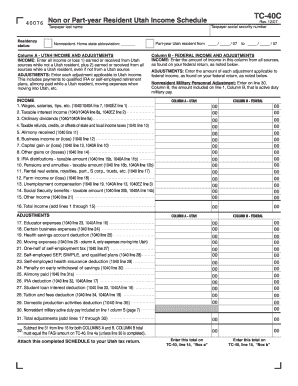

Completing the 40076 Non Or Part-year Resident Utah Income Schedule is an essential step for individuals who have earned income during part of the year while residing in Utah. This guide provides a clear and thorough approach to filling out the form correctly online, ensuring that you meet all necessary requirements and deadlines.

Follow the steps to accurately complete your form online.

- Press the ‘Get Form’ button to access the 40076 Non Or Part-year Resident Utah Income Schedule and open it for editing.

- Begin by entering your last name and social security number in the designated fields.

- Indicate your residency status by selecting either ‘Part-year Utah resident’ or ‘Nonresident’ and provide your home state abbreviation.

- Move to Column A, where you will document all income and adjustments. Enter the income earned from Utah sources while not a Utah resident, and all income earned while a Utah resident, regardless of its source.

- Proceed to list applicable adjustments to your Utah income in Column A, such as payments to qualified retirement plans or moving expenses.

- Now focus on Column B. Here, copy the total income figures from your federal return, including all wages, salaries, and other income.

- Enter any adjustments applicable to your federal income in Column B, including any military personnel adjustments if relevant.

- Calculate the total income for both columns and subtract the total adjustments from the total income for each column.

- Ensure the total from Column B matches the Federal Adjusted Gross Income (FAGI) amount on TC-40, line 4a, unless you completed the nonresident military adjustment.

- Finally, attach this completed schedule to your Utah tax return and enter the totals on TC-40, line 15 for both boxes as indicated.

Start completing your documents online today to ensure accurate filing!

The individual did not spend 183 days or more within the state. A Part-Year Resident is an individual who meets the definition of a resident for only part of the year and non-resident for part of the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.