Loading

Get Uk P11d Ws2 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK P11D WS2 online

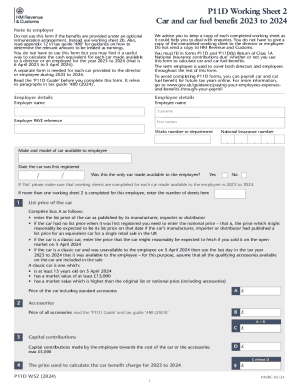

The UK P11D WS2 form is essential for calculating cash equivalents for car and car fuel benefits provided to employees and directors. Completing this form accurately ensures compliance with HM Revenue and Customs regulations for the tax year 2023 to 2024.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in employer details, including employer name, PAYE reference, and work number or department.

- Enter employee details, such as first names, surname, and National Insurance number.

- Provide details about the car, including the make, model, and date of first registration.

- Indicate whether the car was the only one made available to the employee; if not, ensure working sheets are completed for each car.

- Enter the list price of the car as published; if applicable, include the notional price for cars without a list price or classic cars.

- Input the price of accessories associated with the car and enter the combined value of the car and accessories.

- Record any capital contributions made by the employee toward the cost of the car or accessories.

- Calculate the price used for the car benefit charge for the tax year by subtracting capital contributions from the total.

- Determine the appropriate percentage for car benefit calculation based on the car's registration date, fuel type, and emissions.

- Calculate the car benefit charge for the full year, considering any deductions for unavailability and private use.

- Compute the car fuel benefit charge if applicable, applying any necessary deductions for unavailability.

- Finalize by saving your changes, with options to download, print, or share the completed form.

Be proactive and complete your P11D WS2 online for accurate and efficient filing.

The company car fringe benefit should appear on your payslip/IRP5 under source code 3802. The monthly fringe benefit is calculated by taking the cost of your car multiplied by 3.25% (if there is a maintenance plan in place) or 3.5% (with no maintenance plan).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.