Loading

Get Wi Agent Authorization Letter - City Of Appleton 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI Agent Authorization Letter - City Of Appleton online

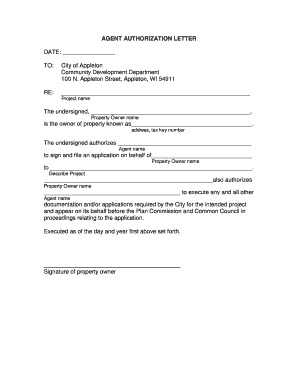

The WI Agent Authorization Letter is a critical document required for authorizing a designated agent to act on behalf of a property owner in the City of Appleton. This guide provides clear and concise instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the date at the top of the form. This date indicates when the authorization is effective.

- In the 'TO' section, write 'City of Appleton, Community Development Department, 100 N. Appleton Street, Appleton, WI 54911'. This specifies the recipient of the letter.

- In the 'RE' field, enter the project name relevant to your authorization. This helps identify the specific project associated with the authorization.

- Provide the property owner's name in the designated space. This identifies the person who has ownership of the property.

- Write the property address and tax key number in the next section. This information is crucial for identifying the property in question.

- In the line for Agent’s name, enter the full name of the agent being authorized. This allows the designated agent to act on behalf of the property owner.

- After that, state the property owner's name again where it states 'on behalf of'. This reinforces who the agent is representing.

- Clearly describe the project for which the agent is being authorized. This section should include any specific details that would help clarify the scope of the project.

- The next line allows for the designation of additional authorization for the agent to execute other documentation. Ensure the agent's name is stated again.

- Finally, the property owner must sign and date at the bottom of the form to validate the authorization.

- Once all information is complete and accurate, save your changes, download the completed form, and you may choose to print or share it as needed.

Complete your documents online today to ensure a smooth authorization process.

The assessed tax rate will increase to $9.48 per $1,000 of valuation. The owner of a $200,000 home will pay $1,896 in property taxes for city services next year. That's an increase of $116. The calculation doesn't include taxes for schools or the county.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.