Loading

Get Mn Ig261 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN IG261 online

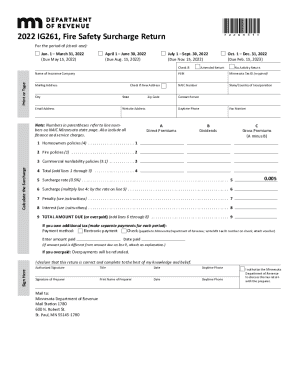

The MN IG261 form is essential for insurers in Minnesota to report fire safety surcharges. This guide provides a clear, step-by-step approach to help users complete the form online efficiently and correctly.

Follow the steps to complete the MN IG261 form online

- Click the ‘Get Form’ button to access the MN IG261 form and open it in your preferred PDF editor.

- Begin by entering your organization’s name, FEIN, and Minnesota Tax ID at the top of the form. Ensure that all information is current.

- Indicate whether the return is an amended return or a no activity return by checking the relevant boxes at the top of the form.

- Fill in the gross premiums for homeowners policies in line 1, as outlined in the instructions. Include any finance or service charges.

- Next, complete line 2 with all fire premiums written, again including any applicable charges.

- On line 3, enter all commercial non-liability premiums written. This should align with the supplemented information from the state page.

- After completing lines 1 through 3, calculate the total by adding these lines together and enter the sum on line 4.

- Determine the surcharge rate as specified on line 5 (0.5%) and calculate the surcharge by multiplying the total from line 4c by the surcharge rate on line 5 to enter on line 6.

- Refer to the instructions to assess if any penalties apply for late payments, entering the calculated amount on line 7.

- Calculate any interest due as stated in the instructions and record this amount on line 8.

- Add the totals from lines 6 through 8 to determine the total amount due or overpaid, entering this figure on line 9.

- Indicate your payment method in the respective section, choosing either electronic payment or check, and provide the amount paid and date.

- Complete the remaining personal and business information, including contact details and authorized signature.

- Finally, save your changes, download a copy of the filled form, and ensure it is mailed to the Minnesota Department of Revenue at the specified address.

Complete your documents online to ensure efficient filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Before starting your Minnesota income tax return (Form M1, Individual Income Tax), you must complete federal Form 1040 to determine your federal taxable income. We use scanning equipment to process paper returns.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.