Loading

Get Entry Summary (form 7501)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Entry Summary (Form 7501) online

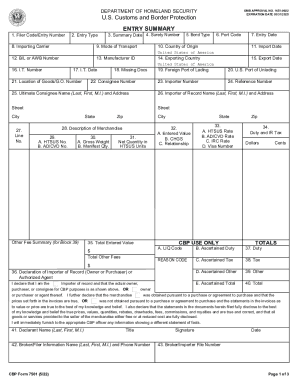

The Entry Summary (Form 7501) is a crucial document for the importation of goods into the United States. This guide provides a detailed, step-by-step approach to completing the form online, ensuring that all necessary information is accurately provided.

Follow the steps to complete the Entry Summary (Form 7501) online.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Enter the filer code and entry number in Block 1. Ensure that the 11-digit alphanumeric entry number is recorded correctly, including leading zeros.

- Select the appropriate entry type code in Block 2 based on the nature of the import, using a two-digit code from the provided list.

- Indicate the summary date in Block 3 by entering the date in MM/DD/YYYY format when the entry summary is submitted.

- Input the surety number from your Customs Bond in Block 4, using '999' for U.S. Government entries.

- Record the bond type in Block 5, choosing from the appropriate single digit code based on the bond type applicable to your entry.

- Provide the U.S. port code in Block 6, using the correct format from the Harmonized Tariff Schedule.

- Enter the entry date in Block 7 using MM/DD/YYYY format, marking the date of goods release.

- Fill in the importing carrier's name in Block 8 if the goods were transported by vessel or air.

- In Block 9, indicate the mode of transport using the applicable two-digit numeric codes.

- Specify the country of origin in Block 10 using the appropriate ISO country code.

- Record the import date in Block 11, noting when the importing vessel arrived or when merchandise entered the U.S.

- Input the Bill of Lading or Air Waybill number in Block 12, ensuring it follows the required format.

- Complete Block 13 with the Manufacturer Identification Code to identify the producer of the goods.

- Indicate the exporting country in Block 14 using the correct ISO code.

- Enter the export date in Block 15 when the carrier departed from the exporting country.

- Fill in Block 16 with the Immediate Transportation number if applicable.

- Record the IT date in Block 17 using MM/DD/YYYY format.

- In Block 18, note any missing documents by using the appropriate code.

- Specify the foreign port of lading in Block 19 if the merchandise arrived by vessel.

- In Block 20, identify the U.S. port of unlading with the correct numeric code.

- Indicate the location of goods or General Order number in Block 21, specifying where goods are available for examination.

- Input the consignee number in Block 22, using the appropriate IRS, SSN, or CBP number.

- Record the importer number in Block 23, formatted according to the provided guidelines.

- Complete Block 24 with the reference number if necessary.

- Provide the ultimate consignee's name and address in Block 25.

- Input the importer of record's name and address in Block 26.

- List the line number in Column 27 sequentially starting from 001.

- Describe the merchandise in Column 28, providing detailed descriptions for classification.

- In Column 29, record the HTSUS number and any applicable AD/CVD case numbers.

- Report the gross weight and manifest quantity in Column 30.

- Provide net quantity in HTSUS units in Column 31 if applicable.

- Record the entered value, charges, and relationship information in Column 32.

- Complete Column 33 with the relevant duty rates and visa numbers as applicable.

- Enter the duty and I.R. tax amounts in Columns 34 and 38 respectively.

- Fill in any other fees in Block 39 and summarize in Block 35.

- Sign and date in Block 41, recording the necessary details.

- Review all entered information for accuracy before final submission.

- Once completed, you may save changes, download, print, or share the form as needed.

Complete your Entry Summary (Form 7501) online today for a seamless import process.

PSC filers can submit these changes within 300 days from the date of entry and up to 15 days of the scheduled liquidation date, whichever date is earlier. If PSCs are filed outside the specified timeframes, ACE will automatically reject it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.