Loading

Get Also Enter This Date In The Space Provided On The Physician's Statement Below - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Also Enter This Date In The Space Provided On The Physician's Statement Below - Tax Ny online

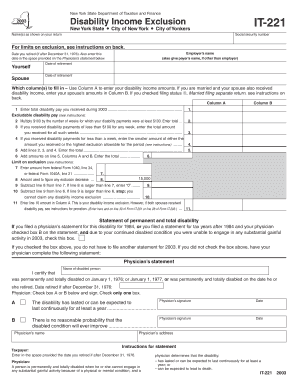

Filling out the Also Enter This Date In The Space Provided On The Physician's Statement Below - Tax Ny form is essential for individuals seeking to exclude disability income from their state income tax. This guide will provide clear, step-by-step instructions to help users complete the form accurately.

Follow the steps to fill out your form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the personal information section by entering your name(s) and social security number as displayed on your tax return. It’s important to ensure that this information matches your legal documents.

- Provide your employer’s name, or the name of the payer if different from your employer. This information is crucial for processing your disability income exclusion.

- Enter the date of your retirement in the specified field. If you retired after December 31, 1976, ensure that you also enter this date in the space provided on the Physician's statement below.

- Complete Column A to enter your total disability income amounts. If applicable, fill in Column B with your spouse’s disability income amounts if they also received such income.

- Proceed to enter the amounts on lines designated for disability pay received during the tax year. Follow the instructions for calculating the excludable disability pay carefully.

- Finally, review your form for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your documents online for a smooth submission process.

Individuals. Use the sum of half of your SSDI benefits plus your other income, either per month or for the whole year, to determine how much of your disability benefits will be taxed: 0% of them, 50% of them, or up to 85% of them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.