Loading

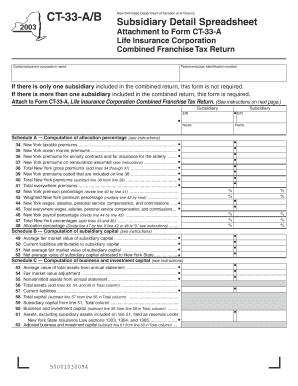

Get Form Ct-33-a/b: 2003 , Subsidiary Detail Spreadsheet, Life ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-33-A/B: 2003, Subsidiary Detail Spreadsheet, Life Insurance Corporation Tax Ny online

Filling out Form CT-33-A/B: 2003, the Subsidiary Detail Spreadsheet for Life Insurance Corporation Tax in New York, requires careful attention to detail. This guide provides step-by-step instructions to help users navigate the online process, ensuring accurate and complete submissions.

Follow the steps to successfully complete your Form CT-33-A/B online.

- Press the ‘Get Form’ button to obtain the form and open it in your selected document editing tool.

- Begin by entering the combined parent corporation name and the parent employer identification number in the respective fields. If there is only one subsidiary included in the combined return, you do not need to complete this form.

- List each subsidiary included in the combined return, providing their name and employer identification number (EIN). Each Form CT-33-A/B can accommodate up to six subsidiaries. If necessary, attach additional forms.

- Proceed to Schedule A. Here, you will compute the allocation percentage by entering amounts for various categories, such as New York taxable premiums and New York gross premiums, following the instructions provided.

- Move on to Schedule B. Compute subsidiary capital by entering the average fair market value of subsidiary capital alongside current liabilities and net values as requested.

- In Schedule C, calculate business and investment capital. Input values for total assets, fair market adjustments, and liabilities to finalize the calculations.

- Continue filling out Schedule D, which involves computations for entire net income. Follow the instructions for each line concerning additions and subtractions.

- Schedule E and Schedule F require additional computations related to alternative bases and premiums. Fill these out according to the guidelines provided in the form.

- After entering all necessary information, review the entire form for accuracy. Save your progress regularly to avoid losing any data.

- Once you have completed the form, you can save the changes, download, print, or share the form as needed. Make sure to attach the completed CT-33-A/B forms to Form CT-33-A.

Begin completing your Form CT-33-A/B online today to ensure your submission is timely and accurate.

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.