Loading

Get Ct-32-a/c Employer Identification Number New York State Department Of Taxation And Finance Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-32-A/C Employer Identification Number New York State Department Of Taxation And Finance Report online

This guide will assist you in completing the CT-32-A/C form, a report required by the New York State Department of Taxation and Finance for banking corporations. Follow these step-by-step instructions to ensure a correct and efficient submission.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the CT-32-A/C form and open it for editing.

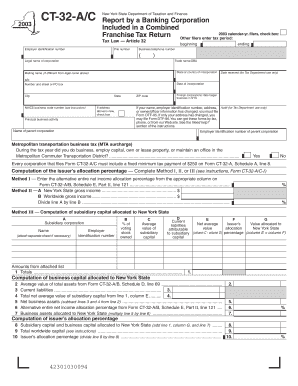

- Begin by filling in the employer identification number, file number, and contact information including the business telephone number and legal name of the corporation.

- Specify your trade name or DBA (doing business as), state or country of incorporation, and provide the mailing address if it differs from the legal name. Ensure to complete the date of incorporation correctly.

- Indicate the NAICS business code based on the business activities. If applicable, enter the date the foreign corporations began business in New York State.

- Complete the section regarding whether your corporation conducted business or maintained an office in the Metropolitan Commuter Transportation District during the tax year, choosing 'Yes' or 'No'.

- Be sure to include the fixed minimum tax payment of $250 on Form CT-32-A, Schedule A, line 8 as it is a required component for all CT-32-A/C filers.

- Proceed to fill out the calculation of the issuer's allocation percentage by selecting Method I, II, or III, as applicable, and enter the required figures accordingly.

- If using Method III, provide details regarding subsidiary corporations, including names, employer identification numbers, and percentages of voting stock owned.

- Complete the computation of business capital allocated to New York State using the prescribed formulas and lines, ensuring all entries are accurate.

- Finalize the computation of issuer's allocation percentage by adding and dividing assets as indicated on the form.

- Move on to the composition of prepayments section, documenting any mandatory first installment and other payments to be credited on the forms specified.

- Sign the certification section of the form, confirming that the information provided is true, correct, and complete.

- After completing all sections, save changes, download, print, or share the form as needed before submitting it.

Begin filing your CT-32-A/C form online today to ensure compliance and timely submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.