Loading

Get Your First Name And Middle Initial Your Last Name (for A Joint Claim, Enter Spouse's Name On Line

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Your First Name And Middle Initial Your Last Name (for A Joint Claim, Enter Spouse's Name On Line online

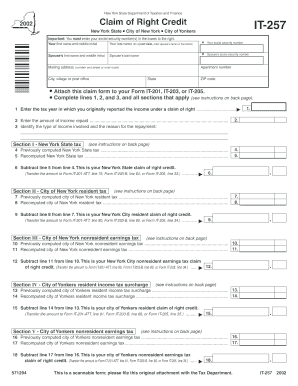

Filling out the tax claim form IT-257 can be a straightforward process when you understand the requirements and steps involved. This guide provides a detailed, user-friendly approach to completing the form accurately and efficiently.

Follow the steps to successfully fill out your claim form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section titled 'Your first name and middle initial', enter your first name followed by your middle initial. If you are filing jointly, enter your partner's name in the designated area below.

- Provide your last name in the specified field. Ensure that the name matches the one associated with your social security number.

- Enter your social security number in the appropriate box. If filing jointly, your partner’s social security number should be filled in the respective section.

- Fill out the mailing address, including the number and street or rural route, city, apartment number (if applicable), state, and ZIP code.

- Complete lines 1, 2, and 3 of the form by entering the tax year in which you originally reported the income, the amount of income repaid, and an explanation of the type of income and reason for repayment.

- Proceed to complete Section I for New York State tax, including both previously computed and recomputed taxes. Subtract to find your claim of right credit.

- Fill out Section II for City of New York resident tax by following similar steps as in Section I.

- Continue with Section III for City of New York nonresident earnings tax and then Section IV for City of Yonkers resident income tax surcharge, ensuring accurate deductions and computations.

- Finally, review all the provided information for accuracy. Save your changes, download, print, or share the form as instructed.

Complete your documents online to ensure a smooth and efficient filing process.

Code 16: Scholarship or fellowship grants.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.