Loading

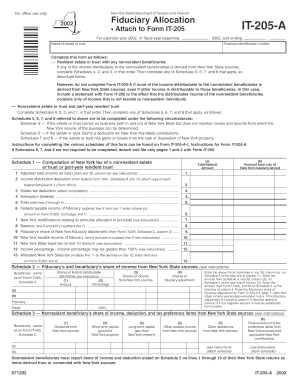

Get For Office Use Only New York State Department Of Taxation And Finance Fiduciary Allocation Attach

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Office Use Only New York State Department Of Taxation And Finance Fiduciary Allocation Attach online

Filling out the For Office Use Only New York State Department Of Taxation And Finance Fiduciary Allocation Attach form can be a straightforward process with the right guidance. This guide provides you with detailed steps to complete each section of the form effectively, ensuring all information is accurately reported.

Follow the steps to complete your fiduciary allocation attach form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the estate or trust in the appropriate field, followed by the employer identification number. Ensure that you have the correct identifying information to avoid any processing issues.

- If the estate or trust is a resident with nonresident beneficiaries, complete Schedules 4, 2, and 3 in that order, paying close attention to the sources of income derived from New York State.

- For nonresident estates or trusts, fill out Schedules 4, 2, 3, and 1 sequentially. Make note of any applicable deductions and ensure accurate reporting of New York State sourced income.

- Complete Schedules 5, 6, 7, and 8 if they apply to your situation. These schedules are focused on income from New York businesses, charitable contributions, and capital gains or losses.

- Review and verify all entries for accuracy. Be careful with calculations and ensure that any necessary attachments, such as copies of federal forms and schedules, are included.

- If Schedules 6, 7, and 8 were not needed, simply detach those pages and file pages 1 and 2 with Form IT-205.

- Once you have completed all necessary sections, save any changes made to the form. You can then download, print, or share the completed document as needed.

Complete your documents online with confidence and ensure accurate submissions for your fiduciary allocations.

If you are the fiduciary of a New York State resident estate or trust, you must file Form IT-205 if the estate or trust: is required to file a federal income tax return for the tax year; had any New York taxable income for the tax year; or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.